Sevana Pension Scheme: Registration, Login, DBT Pension Status & Benefits

In Kerala, social welfare schemes play a key role in supporting vulnerable sections of society. One of the most impactful initiatives is the Sevana Pension Scheme, launched by the Government of Kerala to provide financial assistance to the elderly, widows, disabled persons, unmarried women above 50 years, and agricultural laborers. Managed under the Local Self Government Department (LSGD), the Sevana Pension Kerala scheme is a lifeline for thousands of families.

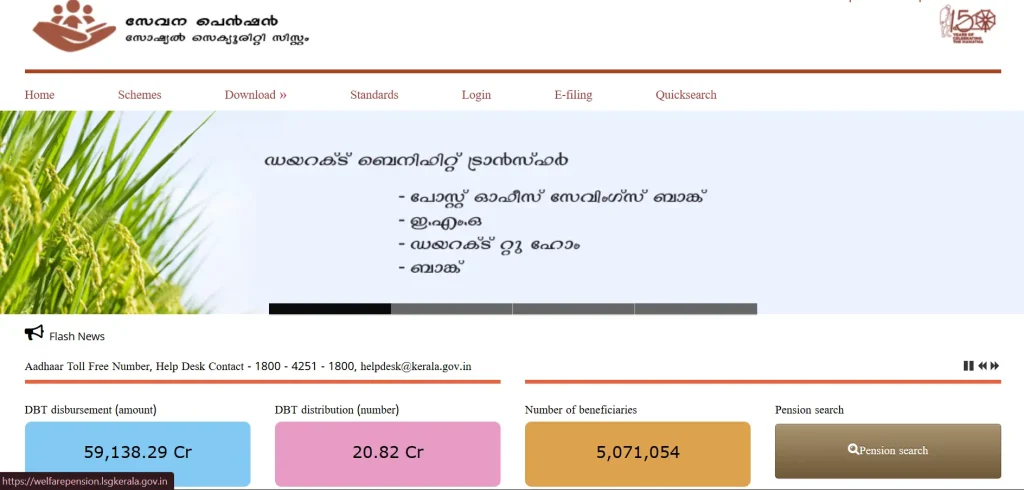

Through this, beneficiaries receive direct monthly financial support into their bank accounts via DBT (Direct Benefit Transfer). The entire process — from sevana pension apply, registration, form submission, mustering, to status check — is now available online, making it easier for citizens to access their benefits transparently.

This article covers everything you need to know about the Scheme, including registration, login, status check, mustering, and complaint redressal system.

What is the Sevana Pension Scheme?

The Scheme is a welfare program launched by the Government of Kerala to support weaker sections of society. Under this scheme, beneficiaries receive a fixed monthly pension directly into their bank accounts. Also read Atal Pension Yojana.

Types of Pensions Kerala:

- Old Age Pension (OAP): For senior citizens above 60 years.

- Widow Pension (WP): For widowed women.

- Disability Pension (DP): For differently-abled individuals.

- Agricultural Labour Pension (ALP): For agricultural workers.

- Unmarried Women Pension (UWP): For unmarried women above 50 years.

| Name of the Scheme | Scheme Details |

| Year | 2024 |

| Launched by | Government of Kerala |

| Type of Pension | 5 Types (Old Age, Widow, Disability, Agricultural Labour, Unmarried Women above 50 years) |

| Beneficiaries | Agriculture labourers, Old age citizens, Disabled citizens, Unmarried women above 50 years of age, Widows |

| Objective | To provide financial support in the form of monthly pension |

| Mode of Application | Online & Offline |

| Category | Central Govt. Scheme (Implemented by Kerala Government) |

| Official Website | welfarepension.lsgkerala.gov.in |

Sevana Pension Registration Process

To get benefits under the Sevana Pension Kerala scheme, eligible applicants must complete the registration process through their respective local bodies (Gram Panchayat, Municipality, or Corporation).

Steps for Registration:

- Visit your Local Self Government Department (LSGD) office.

- Collect the Form.

- Fill in details such as name, age, income, Aadhaar number, and bank details.

- Attach necessary documents (age proof, income certificate, Aadhaar, ration card, bank passbook).

- Submit the application form to the concerned authority.

- After verification, the applicant will be enrolled under the scheme.

Scheme – Latest Statistics 2024

| Particulars | Details |

| DBT Distribution (Amount) | ₹30,734.94 Crore |

| DBT Distribution (Number of Transactions) | 12.57 Crore |

| Total Number of Beneficiaries | 4,868,137 |

| Beneficiaries with Aadhaar Registration | 4,849,262 |

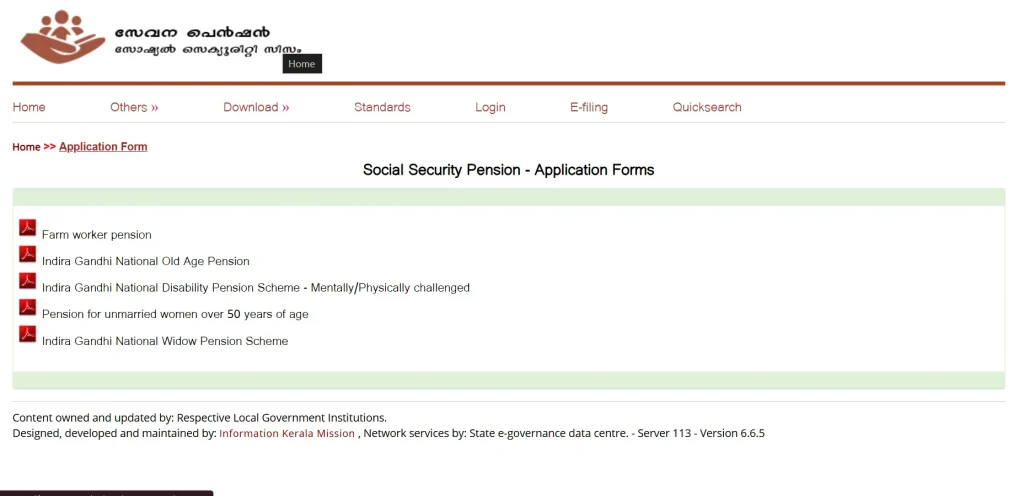

Sevana Pension Application Form

Applicants can access the Sevana Pension Form both offline (through LSGD offices) and online. The form must be filled with accurate details to avoid rejection. Online applications can be made via the Sevana Pension Portal.

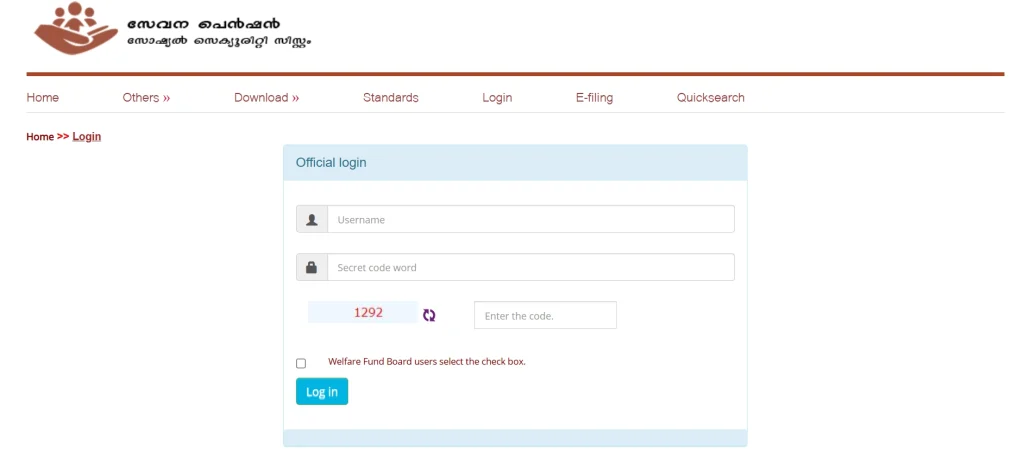

Sevana Pension Login

Registered beneficiaries can use the Login option on the official portal to:

- Check their application status

- Track payment details

- Update bank details

- Submit the complaints

To log in, beneficiaries need their Pension ID/Registration ID and password/OTP.

Sevana Pension Status Check

The government provides an online facility to track the Status. This helps beneficiaries confirm whether their application has been approved and if pension payments are credited to their bank accounts.

Steps to Check Status:

- Visit the official Portal- welfarepension.lsgkerala.gov.in.

- Click on “Status” link.

- Enter your Pension ID or Aadhaar number.

- Enter the captcha code and submit.

- The system will display your application and payment status.

Agricultural Worker Pension under Scheme

The Agricultural Worker Pension is designed to support labourers who work in agricultural fields and belong to economically weaker sections. Initially, this scheme was managed by the Labour Department of Kerala, but as per the revised rules, it is now administered by the Local Self Government Institutions (LSGIs) such as Panchayats, Municipalities, and Corporations.

Under this scheme, applications are collected by the local bodies, verified, and then approved for pension disbursement. The pension amount is directly credited into the bank accounts of the beneficiaries through the Direct Benefit Transfer (DBT) system.

It is the sole responsibility of the local bodies to ensure that the pension is disbursed accurately and on time to all eligible agricultural labourers. With this decentralized structure, the scheme ensures better transparency, accountability, and accessibility for rural workers.

Increase in Agricultural Worker Pension Amount (2000 – 2024)

| Type of Pension | Effective Date (Duration) | Pension Amount (₹) |

| Agriculture Worker Pension | 01/04/2000 | ₹120 |

| Agriculture Worker Pension | 01/04/2007 | ₹130 |

| Agriculture Worker Pension | 01/04/2008 | ₹200 |

| Agriculture Worker Pension | 01/04/2009 | ₹250 |

| Agriculture Worker Pension | 01/04/2010 | ₹300 |

| Agriculture Worker Pension | 01/04/2011 | ₹400 |

| Agriculture Worker Pension | 01/04/2013 | ₹500 |

| Agriculture Worker Pension | 01/04/2014 | ₹600 |

| Agriculture Worker Pension | 01/04/2016 | ₹1000 |

| Agriculture Worker Pension | 01/04/2017 | ₹1100 |

| Agriculture Worker Pension | 01/04/2019 | ₹1200 |

| Agriculture Worker Pension | 01/04/2020 | ₹1300 |

| Agriculture Worker Pension | 01/09/2020 | ₹1400 |

| Agriculture Worker Pension | 01/01/2024 | ₹1500 |

Sevana Pension DBT (Direct Benefit Transfer)

One of the key highlights of the Scheme is that pension amounts are credited directly to beneficiaries’ bank accounts through DBT. This ensures transparency, reduces corruption, and eliminates middlemen. Beneficiaries are advised to regularly check their bank statements to confirm DBT credits.

Eligibility Criteria of Scheme 2024

| Name of Pension | Monthly Amount (₹) | Eligibility Criteria |

| Agriculture Worker Pension | ₹1500 | – Family income ≤ ₹1 lakh – Age ≥ 60 years – Permanent resident of Kerala (10+ years) – Worked as agricultural labour for 10+ years – Landholding ≤ 2 acres – Not income taxpayer – Not a govt. pensioner – No 4-wheeler above 1000cc – Must apply from local body of residence |

| Indira Gandhi National Old Age Pension (OAP) | ₹1500 | – Age ≥ 60 years – Family income ≤ ₹1 lakh – Landholding ≤ 2 acres – Not taxpayer, not pensioner – Resident of Kerala (3+ years) – No 4-wheeler above 1000cc – Apply from local body of permanent residence |

| Indira Gandhi National Old Age Pension (Above 75 Years) | ₹1500 | – Age ≥ 75 years – Family income ≤ ₹1 lakh – Not income taxpayer- Not receiving other social pensions – Resident of Kerala (3+ years) – Landholding ≤ 2 acres – No 4-wheeler above 1000cc – Apply from local body of permanent residence |

| Indira Gandhi National Disability Pension (80% or more disabled) | ₹1500 | – No age limit – Must hold disability certificate/ID from Social Security Mission – Family income ≤ ₹1 lakh – Landholding ≤ 2 acres – Not income taxpayer – Can receive max. 2 pensions (including EPF) – Not a govt. pensioner – No 4-wheeler above 1000cc – Apply from local body of permanent residence |

| Indira Gandhi National Disability Pension (Physically/Mentally Challenged) | ₹1500 | – No age limit – Disability certificate/ID from Social Security Mission – Family income ≤ ₹1 lakh – Not taxpayer, not pensioner – Landholding ≤ 2 acres- Max. 2 pensions allowed – No 4-wheeler above 1000cc – Resident of Kerala (permanent) |

| Unmarried Women Pension (Above 50 years) | ₹1500 | – Age ≥ 50 years – Must be unmarried (unmarried mothers also eligible)- Family income ≤ ₹1 lakh – Resident of Kerala- Not taxpayer, not pensioner – Landholding ≤ 2 acres (except ST applicants) – No 4-wheeler above 1000cc – Apply from local body of permanent residence |

| Indira Gandhi National Widow Pension | ₹1500 | – Must be a widow for at least 7 years – Family income ≤ ₹1 lakh – Permanent resident of Kerala (2+ years) – Not taxpayer, not pensioner – Landholding ≤ 2 acres (except ST) – No 4-wheeler above 1000cc- Cannot remarry – Apply from local body of permanent residence |

Sevana Pension Muster Roll / Mustering

Mustering is a process where beneficiaries must physically verify their identity at local bodies once or twice a year. This ensures that only genuine beneficiaries continue to receive pensions.

- Beneficiaries need to visit the Panchayat/Municipality/Corporation office during mustering.

- They must produce their Aadhaar card and Pension ID for verification.

- Failure to attend mustering may result in pension suspension.

How to Apply Online?

The government has made it easier for citizens to apply for an online pension.

Steps for Online Application:

- Visit the official Portal- welfarepension.lsgkerala.gov.in.

- Select Apply / Registration option.

- Fill in personal details, Aadhaar number, and bank details.

- Upload scanned documents (age proof, ration card, income certificate, etc.).

- Submit the form online and note down the registration number.

- Track application progress through the status option.

Documents Required for Application

- Aadhaar Card

- Age Proof (Birth Certificate / School Certificate)

- Bank Passbook (for DBT)

- Ration Card

- Income Certificate

- Passport-size Photograph

- Death Certificate (for widow pension)

- Disability Certificate (for disability pension)

Sevana Pension Complaints

The Kerala Government has set up an online and offline grievance redressal system for complaints.

Beneficiaries can:

- Lodge complaints through the Portal (Online Grievance System).

- Visit their respective local body office for complaint registration.

- Call the State Helpdesk numbers for urgent issues related to pension delays, mustering, or DBT.

Benefits of Kerala Pensions

- Financial support to weaker sections of society.

- Transparent payment system via DBT.

- Covers multiple categories of citizens (elderly, widows, disabled, agricultural workers, unmarried women).

- Online facilities for registration, status, login, and complaints.

- Prevents misuse through mustering verification.

Conclusion

The Pension Scheme Kerala is a vital lifeline for underprivileged groups, ensuring financial stability and dignity. With facilities like sevana pension registration, login, status check, DBT payments, and mustering verification, the process has become transparent and citizen-friendly.

If you are eligible, you should complete your apply and registration process through the local body or official portal to avail of the benefits.

FAQs

It is a welfare scheme by the Kerala government that provides financial assistance to the elderly, widows, disabled, unmarried women, and agricultural workers.

You can check status online via the Portal using your Pension ID or Aadhaar.

It is the Direct Benefit Transfer system where pension is directly credited to beneficiaries’ bank accounts.

You can apply through the local body office or submit an online Sevana Application.

It is the physical verification process where beneficiaries confirm their eligibility by visiting local bodies.

Complaints can be submitted online through the portal or at the local self-government office.