Unified Pension Scheme: Eligibility, Benefits, and Latest News

The Unified Pension Scheme (UPS) has become one of the most discussed topics in India, especially among government employees, private-sector workers, and financial planners. Designed to bring together different pension systems under one umbrella, this scheme ensures long-term financial security for retirees.

With rising inflation and growing demands for post-retirement support, the UPS aims to strike a balance between old pension provisions and new-age retirement plans. This article will cover everything you need to know, including details, notifications, tax benefits, gratuity rules, latest news, and even UPSC relevance. Also Read Vidhwa Pension Yojana.

What is Unified Pension Scheme?

The Unified Pension Scheme is a retirement plan that seeks to integrate the Old Pension Scheme (OPS) and the National Pension System (NPS) into a balanced structure. It addresses concerns of government employees while ensuring financial discipline for the state.

- OPS offered guaranteed pensions (50% of last drawn salary).

- NPS linked pensions to market returns, often leading to uncertainty.

- UPS combines the best of both – offering a mix of guaranteed pension, gratuity, and market-linked growth.

Scheme Details

Here are the key highlights of the UPS details:

| Feature | Details |

| Scheme Name | Unified Pension Scheme (UPS) |

| Objective | To integrate OPS & NPS for better retirement security |

| Eligibility | Government employees, certain private-sector workers (future scope) |

| Pension Type | Combination of fixed (OPS style) + market returns (NPS style) |

| Minimum Pension | Likely between ₹7,500 – ₹10,000 (as per early drafts) |

| Gratuity | Included for eligible employees |

| Tax Benefits | Under Sections 80C, 80CCD, and pension exemptions |

| Implementation | Expected after official UPS notification |

| Website | pfrda.org.in |

UPS: Relevance in UPSC

The Unified Pension Scheme UPSC topic has huge significance for civil service aspirants. It falls under:

- Indian Economy (Social Security & Pensions)

- Government Policies & Welfare Measures

- Current Affairs (Latest News & Notifications)

Aspirants preparing for UPSC prelims and mains must focus on:

- Difference between OPS, NPS, and UPS.

- Fiscal implications of pension schemes.

- Long-term sustainability of pensions in India.

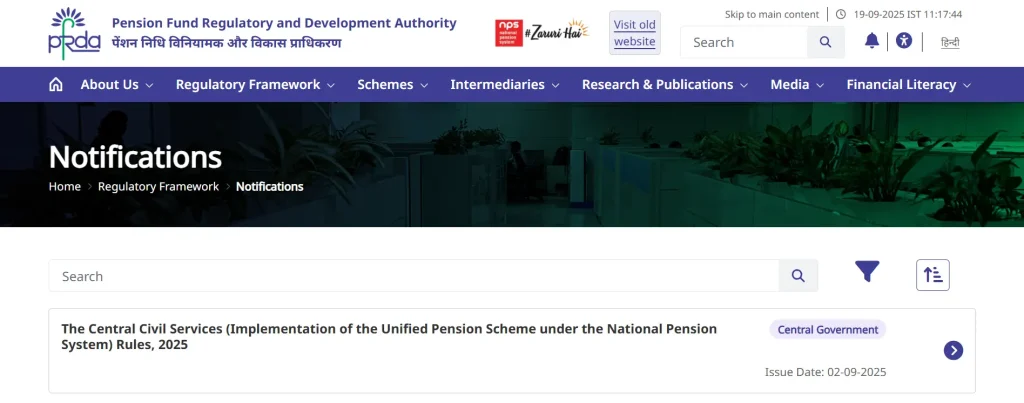

Scheme Notification

The Unified Pension Scheme notification will be released by the Ministry of Finance and respective state governments. The notification will clarify:

- Eligibility criteria.

- Pension calculation formula.

- Contribution percentages.

- Gratuity and tax provisions.

- Implementation timeline.

Employees and pensioners should regularly check the official finance ministry website (pfrda.org.in)or latest government circulars for updates.

UPS Latest News

The latest news suggests that:

- The government is considering a hybrid pension model.

- Several states like Rajasthan, Chhattisgarh, and Himachal Pradesh have demanded OPS restoration, leading to UPS discussions.

- A committee has been formed to finalize pension formulas under UPS.

- Implementation may begin in phases from 2025 onwards.

Unified Pension Scheme Calculator

A calculator will help employees estimate their post-retirement income. The calculator usually requires:

- Last drawn salary

- Years of service

- Contribution details

- Retirement age

Based on these, the calculator shows:

- Fixed pension (OPS component)

- Market-linked returns (NPS component)

- Gratuity entitlement

- Taxable and non-taxable income portions

This tool will be crucial for employees planning early retirement.

Schemes Gratuity

Another highlight is the gratuity provision. Under UPS, eligible employees will continue to receive:

- Gratuity after minimum 5 years of service

- Calculated as per last drawn basic salary + dearness allowance

- Maximum gratuity amount as per updated government rules

This ensures employees get a lump-sum benefit at retirement along with monthly pensions.

Unified Pension Scheme Eligibility

The UPS has specific eligibility criteria designed to cover a wide range of employees, primarily in the government sector. Below are the key points:

| Eligibility Criteria | Details |

| Type of Employees | Central government employees, state government employees, and other categories currently under NPS (post-2004 recruits). |

| Age Limit | Must have joined government service after 01 January 2004 (for NPS-covered employees). Retirement age will be as per service rules. |

| Service Period | Minimum 10 years of qualifying service is generally required to claim pension benefits. |

| Employment Status | Regular/permanent employees are eligible. Contractual staff may not be covered unless notified separately. |

| Private Sector Employees | Not included yet, but the scheme may be extended in future phases. |

| Family Benefits | Spouse/nominee eligible for family pension in case of employee’s demise. |

| Contributions | Both employee and employer (government) contributions required, similar to NPS structure. |

| Special Category | Women employees, disabled employees, and dependents may get additional relaxations as per notification. |

Unified Pension Scheme Tax Benefits

The tax benefits are expected to be highly favorable:

- Section 80C & 80CCD deductions on employee contributions.

- Employer’s contribution exempt from tax.

- Pension income partially tax-free up to a certain limit.

- Gratuity received under UPS exempt from tax as per existing gratuity rules.

- Withdrawal benefits aligned with NPS-like tax reliefs.

This will make UPS an attractive retirement option for employees.

Advantages of Scheme

- Financial Security – Combines OPS stability with NPS growth.

- Predictable Retirement Income – Fixed pension ensures safety.

- Wealth Creation – Market-linked returns boost long-term savings.

- Tax Savings – Multiple exemptions reduce tax burden.

- Gratuity Benefits – Lump-sum amount supports large expenses.

Challenges of Scheme

- Fiscal Burden: Higher pensions may stress government finances.

- Implementation Issues: Need for nationwide acceptance.

- Balancing OPS & NPS: Ensuring fairness for both old and new employees.

- Awareness Gap: Employees need proper education about scheme details.

Unified Pension Scheme vs Old and New Systems

| Feature | Old Pension Scheme (OPS) | National Pension System (NPS) | Unified Pension Scheme (UPS) |

| Pension Guarantee | Yes (50% of last salary) | No (market-linked) | Partial guarantee + returns |

| Gratuity | Yes | Limited | Yes |

| Tax Benefits | Limited | Section 80C & 80CCD | Enhanced benefits |

| Financial Sustainability | High burden | Sustainable | Balanced |

Who Will Benefit from the Scheme?

- Government employees (central & state) recruited after 2004 (NPS workers).

- Retiring employees needing predictable pension.

- Families of employees eligible for gratuity & survivor benefits.

- UPSC aspirants & academicians, as this will remain a major policy debate.

Unified Pension Scheme – Future Scope

- May extend to private-sector workers for retirement security.

- Likely to include self-employed professionals through voluntary contributions.

- Could integrate with social security measures for unorganized workers.

Conclusion

The Unified Pension Scheme represents a historic step toward balancing employee welfare with government financial sustainability. By blending the assured income of OPS and the investment potential of NPS, UPS can truly transform retirement planning in India.

Employees, UPSC aspirants, and policymakers must stay updated on notification, latest news, calculator tools, gratuity provisions, and tax benefits.

As India moves toward economic stability, the UPS is expected to provide retirees with the dignity, financial security, and independence they deserve.

FAQs

It is a hybrid retirement plan that merges features of OPS and NPS to ensure financial security for employees.

Primarily government employees under NPS, though future expansion may include private workers.

Contributions are tax-deductible, gratuity is tax-free, and pensions enjoy partial exemptions.

Use the UPS calculator, which considers salary, service years, and contributions.

The government is expected to roll out UPS in 2025 after final committee recommendations.

Yes, eligible employees will continue to receive gratuity benefits along with monthly pension.