Open NPS Account Online: National Pension Scheme (NPS)

Planning for retirement is one of the most important financial goals in everyone’s life. With increasing life expectancy and rising living costs, having a stable income source after retirement has become essential. The National Pension Scheme (NPS), introduced by the Government of India, is one of the most reliable retirement solutions for salaried individuals, self-employed professionals, and business owners.

In this article, we will cover everything you need to know about the NPS, including its benefits, eligibility, tax advantages, contribution structure, and details about the National Pension Scheme Vatsalya Scheme, calculator, login process, and more.

What is the National Pension Scheme?

The NPS is a government-backed retirement savings plan launched by the Pension Fund Regulatory and Development Authority (PFRDA). It is designed to provide financial security and regular income after retirement. Individuals contribute systematically during their working years, and these contributions grow through market-linked returns. At retirement, the accumulated corpus can be partially withdrawn, while the remaining is used to purchase an annuity to ensure a steady pension.

Also Read NPS Vatsalya Pension Scheme.

National Pension Scheme (NPS) Overview

| Feature | Details |

| Scheme Name | National Pension Scheme (NPS) |

| Regulator | Pension Fund Regulatory and Development Authority (PFRDA) |

| Account Types | Tier-I (mandatory), Tier-II (optional) |

| Eligibility | Indian citizens (Resident & NRI), 18–70 years |

| Minimum Contribution | Tier-I: ₹500 per contribution, ₹1,000 per yearTier-II: ₹250 per contribution |

| Maximum Contribution | No upper limit |

| Lock-in Period | Till 60 years (can extend to 70 years) |

| Withdrawal Rules | At 60: 60% lump sum (tax-free) + 40% annuityPartial withdrawals allowed for education, marriage, medical needs |

| Returns (Interest Rate) | Market-linked, typically 8–10% annually |

| Fund Options | Equity, Corporate Debt, Government Bonds, Alternative Assets |

| Investment Modes | Active Choice (self-select allocation)Auto Choice (age-based allocation) |

| Tax Benefits | – Section 80CCD(1): up to ₹1.5 lakh (under 80C)- Section 80CCD(1B): extra ₹50,000- Section 80CCD(2): employer contribution (10% of salary) |

| Annuity Requirement | Minimum 40% of corpus to be invested in annuity at retirement |

| Portability | Fully portable across jobs and locations |

| NPS Login | enps.nps-proteantech.in |

| Special Variant | NPS Vatsalya Scheme for retirement-focused savings |

National Pension Scheme Details

Before investing, it’s crucial to understand the NPS details:

- Launched by: Government of India & managed by PFRDA

- Type of Scheme: Defined contribution retirement plan

- Who can invest: Indian citizens (18–70 years)

- Contribution: Minimum ₹500 per contribution, ₹1,000 per year

- Maturity Age: 60 years (can extend till 70)

- Withdrawal: 60% lump sum (tax-free), 40% used for annuity purchase

Types of NPS Accounts

- Tier-I Account:

- Mandatory retirement account

- Withdrawal restricted until 60 years (partial allowed for specific purposes)

- Tax benefits available

- Mandatory retirement account

- Tier-II Account:

- Voluntary savings account

- Flexible withdrawals

- No tax benefits unless the investor is a government employee

- Voluntary savings account

National Pension Scheme Vatsalya Scheme

The NPS Vatsalya Scheme is a special initiative under the NPS framework. It is designed to provide financial security to individuals after retirement, focusing on systematic contributions during working years. This scheme is ideal for those who want a dedicated pension plan with additional benefits for long-term security. It combines the standard NPS features with flexible options to ensure retirees live a stress-free life.

National Pension Scheme Calculator

Planning contributions is easier with the NPS calculator. This online tool helps individuals estimate:

- Future retirement corpus

- Monthly pension amount

- Total contributions over time

- Tax savings

For example, if you invest ₹5,000 per month at the age of 30 until retirement (60 years), the NPS calculator will show the projected corpus based on expected returns (8–10%). This transparency makes it easier for investors to decide contribution levels.

NPS Chart

The NPS chart represents the asset allocation between equity, corporate debt, government bonds, and alternate investment funds. Investors can choose between:

- Active Choice – Decide allocation manually (max 75% in equity until age 50).

- Auto Choice – Allocation automatically changes with age to balance risk and safety.

This chart ensures a clear understanding of how funds are invested for maximum retirement benefits.

National Pension Scheme Eligibility

The NPS eligibility is simple:

- Age: Any Indian citizen between 18 and 70 years can join.

- KYC: Must have valid ID, address proof, and Aadhaar/PAN card.

- Employment: Open to salaried employees, self-employed professionals, and even NRIs.

This inclusivity makes NPS one of the most accessible retirement plans in India.

National Pension Scheme Benefits

The NPS benefits are extensive:

- Retirement Security: Regular pension ensures financial independence.

- Market-Linked Growth: Returns typically range between 8–10%.

- Low-Cost Investment: Fund management charges are among the lowest in the world (0.01%).

- Flexibility: Choice of fund manager, asset allocation, and contribution levels.

- Portable: Account remains active even if you change job, city, or sector.

- Partial Withdrawals: Allowed for higher education, marriage, or medical needs.

- Tax Savings: Generous deductions under different sections of the Income Tax Act.

National Pension Scheme Tax Benefit

The NPS tax benefit makes it highly attractive:

- Section 80CCD(1): Up to ₹1.5 lakh deduction (part of 80C limit).

- Section 80CCD(1B): Additional ₹50,000 deduction exclusively for NPS.

- Section 80CCD(2): Employer contribution up to 10% of basic + DA (without monetary cap).

This means an individual can save up to ₹2 lakh annually in taxes while building a retirement fund.

NPS Interest Rate

The interest rate is not fixed like a traditional FD. Instead, returns depend on the performance of equity, debt, and government securities. Historically, NPS has delivered 8–10% annual returns over the long term, making it one of the most rewarding retirement investments.

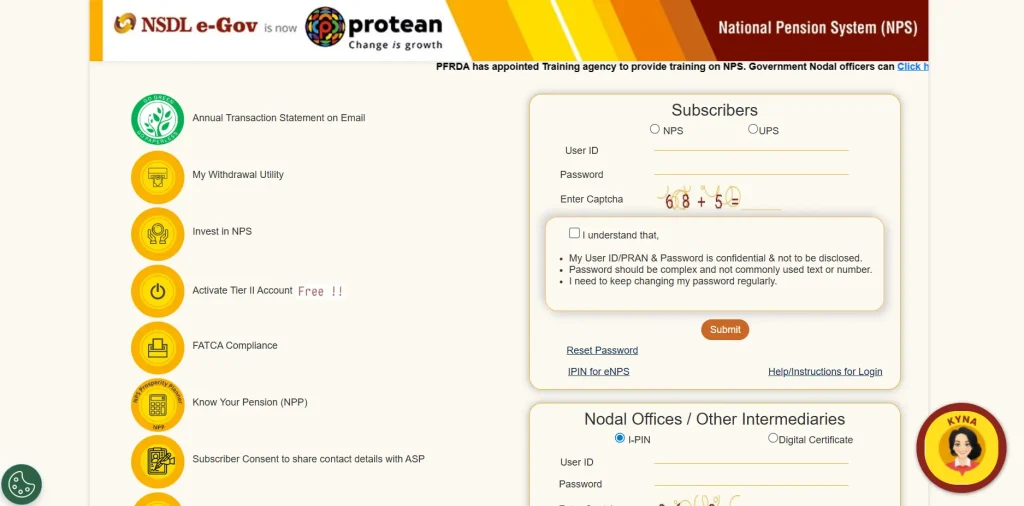

National Pension Scheme Login Process

To manage your account, you can use the login option:

- Visit the CRA (Central Recordkeeping Agency) website (cra-nsdl.com).

- Click on NPS Login.

- Enter your PRAN (Permanent Retirement Account Number) and password.

- Access account balance, contributions, and statements.

This online facility makes it simple to monitor and manage your retirement savings anytime.

Why Choose the National Pension Scheme Over Other Retirement Plans?

- Government-backed security: NPS is regulated by PFRDA, ensuring trust.

- Higher returns than PPF/EPF: Due to equity exposure.

- Flexible contributions: No need for fixed monthly investments; contribute as per convenience.

- Annuity option: Ensures guaranteed pension after retirement.

How to Open a NPS Account?

You can open an NPS account in two ways:

1. Online (eNPS):

- Visit the official NPS portal (enps.nps-proteantech.in).

- Register with PAN/Aadhaar and mobile number.

- Choose account type (Tier-I / Tier-II).

- Select fund manager and investment option.

- Complete e-signature and KYC.

2. Offline:

- Visit nearest Point of Presence (POP) such as banks or post offices.

- Fill out registration form.

- Submit KYC documents and contribution.

- Receive PRAN card.

NPS Withdrawal Rules

- At 60 years: Withdraw up to 60% lump sum (tax-free). Remaining 40% must be invested in annuity.

- Before 60 years: Allowed only if you have completed at least 10 years; max 20% lump sum, rest in annuity.

- Partial Withdrawal: Up to 25% of contributions allowed after 3 years for specific purposes.

NPS for NRIs

Even Non-Resident Indians (NRIs) can invest in NPS. They need:

- Valid Indian passport and bank account

- Age between 18–70 years

- Compliance with FEMA regulations

This makes NPS an excellent retirement solution for Indians living abroad.

Conclusion

The National Pension Scheme is one of the most effective retirement planning tools in India. It offers security, flexibility, and tax savings while ensuring a regular pension post-retirement. Whether you are a young professional, self-employed, or nearing retirement, NPS can help you achieve long-term financial independence.

With the added advantage of the NPS Vatsalya Scheme, easy NPS login, detailed NPS calculator, and lucrative tax benefits, this scheme is an excellent choice for securing your golden years.

Start early, invest consistently, and let the NPS build a worry-free retirement for you.

Frequently Asked Questions (FAQs)

Yes, since it is regulated by PFRDA and backed by the Government of India.

Till 60 years of age, though partial withdrawals are allowed.

Yes, once in a financial year.

Permanent Retirement Account Number, a unique ID for every subscriber.

No. Every subscriber can have only one NPS account that comes with a unique PRAN number. However, you can hold both Tier-I and Tier-II accounts under the same PRAN.

Yes. Subscribers can switch between Active Choice and Auto Choice and also change the asset allocation percentage within limits.