NPS Vatsalya Pension Scheme 2025: Complete Guide for Investors

Retirement planning has become one of the most crucial aspects of financial security in India. With inflation rising and life expectancy increasing, individuals are looking for reliable pension schemes that ensure steady income in their golden years. Among several initiatives, the NPS Vatsalya Pension Scheme has emerged as a structured, government-backed solution to secure financial independence post-retirement.

What is NPS Vatsalya Pension Scheme?

The government launched this Pension Scheme under the National Pension System (NPS) framework. It helps individuals achieve financial stability after retirement by allowing them to make systematic contributions during their working years.

The scheme combines long-term investment growth with pension benefits, ensuring a stable income stream once the subscriber retires.

Also Read Unified Pension Scheme.

Key Features:

- Backed by the Government of India

- Market-linked returns with long-term growth potential

- Provides lifelong pension through annuities

- Flexibility in contribution amount and frequency

- Offers tax benefits under Income Tax laws

NPS Vatsalya Pension Scheme Launch Date

The Scheme was launched as part of the government’s efforts to strengthen India’s pension infrastructure. The official launch date was aligned with reforms in the retirement planning sector, giving employees, self-employed professionals, and even unorganized sector workers access to pension benefits.

NPS Vatsalya Scheme Details

Here’s a structured breakdown of the NPS Scheme details:

| Parameter | Details |

| Scheme Name | NPS Vatsalya Pension Scheme |

| Objective | To provide post-retirement income security |

| Eligible Subscribers | Government employees, private-sector employees, self-employed individuals |

| Contribution Type | Flexible – monthly, quarterly, or annual |

| Minimum Contribution | ₹500 per contribution |

| Retirement Age | 60 years (with options for early exit under rules) |

| Withdrawal Options | Partial withdrawals allowed for specific needs |

| Annuity/Pension | Mandatory purchase of annuity for a portion of the corpus |

| Tax Benefits | Deductions under Section 80C & 80CCD |

| Interest Rate | Market-linked, historically between 8–10% |

| Online Access | npstrust.org.in |

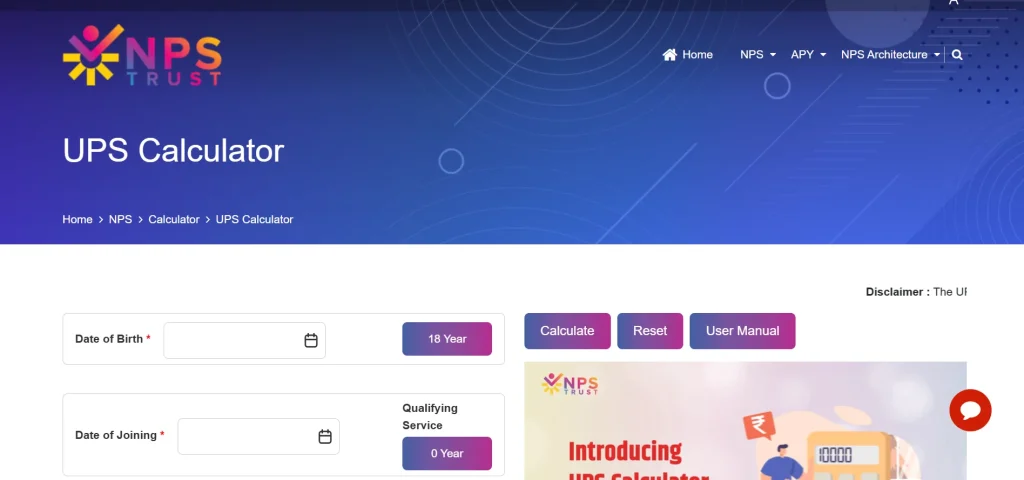

NPS Vatsalya Calculator

Before investing, it’s important to estimate how much pension one can expect. The calculator is an online tool that allows subscribers to calculate their expected pension corpus and monthly payouts based on:

- Age of entry

- Monthly contribution

- Expected rate of return

- Retirement age

How to Use the NPS Calculator:

- Visit the official NPS portal (npstrust.org.in) or authorized financial websites.

- Enter details like current age, contribution amount, and retirement age.

- Adjust the Interest rate (expected returns).

- The calculator will show:

- Final retirement corpus

- Monthly pension amount post-annuity purchase

- Final retirement corpus

This helps investors make informed decisions and plan contributions accordingly.

NPS Vatsalya Pension Scheme Login – How to Access Your Account

Subscribers can manage their account, contributions, and withdrawals through the login portal.

Steps for Login:

- Visit the official NPS portal (npstrust.org.in).

- Select Subscriber Login.

- Enter your PRAN (Permanent Retirement Account Number) and password.

- Complete OTP verification.

- Access your account to check contributions, pension corpus, and withdrawal eligibility.

NPS Vatsalya Tax Benefits

One of the strongest features of the NPS Yojana is its tax efficiency.

Tax Benefits Include:

- Section 80C: Deduction up to ₹1.5 lakh on contributions.

- Section 80CCD(1B): Additional ₹50,000 deduction available.

- Employer Contribution: Up to 10% of salary exempt under Section 80CCD(2).

- Maturity Proceeds: Partially tax-free at withdrawal.

- Annuity/Pension: Pension received is taxable as per income slab, but annuity purchase is tax-deferred.

These tax benefits make it one of the most attractive retirement savings schemes in India.

What are the Withdrawal Rules?

Subscribers can withdraw from the scheme under certain conditions:

- On Retirement (60 years)

- Up to 60% of the corpus can be withdrawn tax-free.

- Remaining 40% must be used to purchase an annuity for lifelong pension.

- Up to 60% of the corpus can be withdrawn tax-free.

- Partial Withdrawal

- Allowed after 3 years of account opening.

- Maximum 25% of contributions can be withdrawn.

- Purpose must be specific like higher education, marriage, or medical treatment.

- Allowed after 3 years of account opening.

- Early Exit (Before 60 years)

- Allowed if the subscriber has completed at least 10 years in the scheme.

- 20% can be withdrawn as a lump sum.

- 80% must be converted into annuity.

- Allowed if the subscriber has completed at least 10 years in the scheme.

NPS Vatsalya Interest Rate

Unlike traditional pension plans, the interest rate is market-linked. This means the returns depend on the performance of underlying assets such as equities, government securities, and corporate bonds.

- Historically, NPS schemes have delivered 8–10% annualized returns over the long term.

- Subscribers can choose from different fund options based on their risk appetite.

- Automatic allocation options (Auto Choice) are available for hassle-free investment.

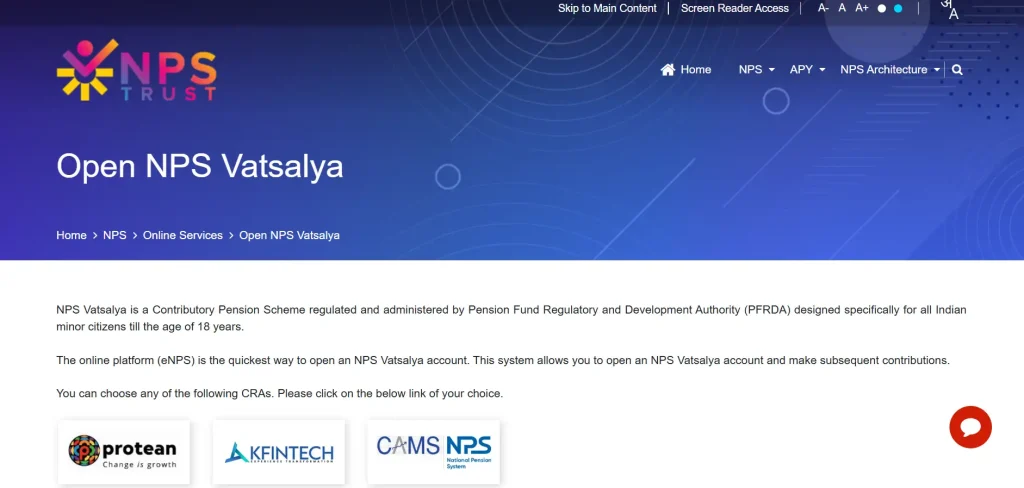

What Happens to the NPS Account When the Child Turns 18?

One of the unique aspects of this Pension Scheme is that it allows parents or guardians to open an NPS account in the name of a minor. This ensures early financial planning for the child’s secure future.

When the child turns 18 years old, the account undergoes an important transition:

- The account becomes a standard NPS Tier I account.

- A re-KYC (Know Your Customer) process is mandatory within three months of the child turning 18.

- Once the re-KYC is completed, the child receives full rights to operate and manage the account.

- From that point onward, the child can independently decide on contributions, asset allocation, and withdrawals.

This smooth transition ensures that the investments made during their early years continue to grow, providing a solid financial foundation for the future.

Why NPS Vatsalya is the Best Child Future Investment Plan?

Most child investment plans in India, such as PPF, Sukanya Samriddhi Yojana, or insurance-based ULIPs, focus primarily on short-term goals like education or marriage. While these are important, they do not address long-term retirement planning for the child.

The Pension Scheme fills this gap by providing a retirement-focused financial solution right from childhood.

Key Reasons – Why it Stands Out?

- Low-Cost and Transparent

- The NPS framework is one of the lowest-cost pension schemes in India.

- With government regulation and strict transparency, subscribers can track their corpus growth through the login portal (npstrust.org.in).

- The NPS framework is one of the lowest-cost pension schemes in India.

- PRAN Generation for Minors

- A unique Permanent Retirement Account Number (PRAN) is created even for minors.

- This PRAN ensures lifelong continuity of savings, easily managed online.

- A unique Permanent Retirement Account Number (PRAN) is created even for minors.

- Flexible Investment Options

- Subscribers can choose between Auto Choice (age-based asset allocation) or Active Choice (self-selected allocation across equities, government bonds, and corporate debt).

- Subscribers can choose between Auto Choice (age-based asset allocation) or Active Choice (self-selected allocation across equities, government bonds, and corporate debt).

- Smooth Transition at 18 Years

- Unlike many schemes that mature early, continues seamlessly after the child turns 18.

- The child inherits a growing corpus and can continue saving for future financial security.

- Unlike many schemes that mature early, continues seamlessly after the child turns 18.

- Superior to Traditional Child Plans

- PPF: Limited contribution ceiling and fixed returns.

- Sukanya Samriddhi Yojana: Restricted to girl children with fixed maturity terms.

- ULIPs: Higher costs and less transparency.

- About Scheme: Flexible, transparent, market-linked growth with long-term pension benefits.

- PPF: Limited contribution ceiling and fixed returns.

Benefits of NPS Pension Scheme

- Financial Security – Ensures steady income post-retirement.

- Flexibility – Choose contribution amount and investment style.

- Government Backing – Safer compared to purely private schemes.

- Transparency – Online access via login.

- Tax Savings – Multiple tax deductions and exemptions.

- Portability – PRAN number remains valid across job changes.

Who Should Invest in NPS Vatsalya?

- Government Employees – For additional retirement benefits.

- Private-Sector Professionals – To build long-term retirement corpus.

- Self-Employed Individuals – Secure income in old age.

- Young Investors – Start early to maximize benefits from compounding.

Conclusion

The NPS Vatsalya Pension Scheme is a powerful tool for retirement planning in India. With flexible contributions, attractive tax benefits, market-linked returns, and lifelong pension, it provides both financial stability and peace of mind.

Whether you are a government employee, private professional, or self-employed, the Vatsalya Yojana ensures that you can retire with dignity and independence.

If you haven’t started yet, use the calculator today, check your estimated pension, and take the first step toward securing your future.

FAQs

It’s a government-backed pension plan under NPS that ensures retirement income through long-term contributions.

Use the calculator to estimate corpus and pension payouts.

Yes, the scheme offers deductions under Sections 80C and 80CCD, plus exemptions on maturity.

Yes, partial and early withdrawals are allowed under specific conditions.

Returns are market-linked, historically between 8–10% annually.